The Conflict: Legal Entity vs. Buying Group

In the modern enterprise, the definition of a “customer” is fractured. It exists simultaneously as a legal construct designed for liability containment and tax optimization, and as an operational organism designed for purchasing and market execution. This duality creates a fundamental crisis for revenue teams: the question “Who is the customer?” has two correct but contradictory answers depending on whether you ask the Chief Financial Officer (CFO) or the Chief Revenue Officer (CRO).

Comparison: Financial vs. Sales Hierarchy Data Models

| Dimension | Finance Hierarchy(Legal Ownership) | Sales Hierarchy(Brand / Operating Group) |

|---|---|---|

| The “Truth Test” Question | “Which parent is responsible for compliance exposure (sanctions/KYC/AML)?” | “Who owns the budget and the decision for this category?” |

| Primary Use Cases | • Signing contracts & choosing the billing entity • Credit checks (KYC/AML), sanctions screening, & parent guarantees • Rolling up risk/exposure & legal reporting |

• Routing leads & assigning territories • ABM targeting & running campaigns • Planning pipeline coverage by brand/flag • Partner motions & playbook outreach |

| How to Determine It & Sources | Based on Official Registries & Filings. Uses ownership records, legal entity data, and regulatory databases to trace ultimate control. | Based on Commercial Signals. Uses official websites, press releases, financial reports. |

| Ideal CRM Application | • The Billing/Contracting Entity • Credit & Compliance Workflows • Legal Reporting Rollups |

• Territory Assignment Fields • Account Planning & Forecasting • ABM Segmentation & Campaign Execution |

| Failure Mode (If Misaligned) | Compliance & Financial Risk: Wrong contracting entity, failed compliance checks, incorrect exposure rollups, and collections issues. | Revenue Leakage & Conflict: Territory conflicts, wrong account ownership, mis-credited commissions, missed cross-sell, and duplicated outreach. |

This structural misalignment is known as the Account Hierarchy dilemma.

The Account Hierarchy Dilemma is the conflict between the ‘Ultimate Legal Parent’ (used by Finance for liability) and the ‘Effective Buying Center’ (used by Sales for revenue execution).

- The Finance Hierarchy (Liability View): Prioritizes the “Ultimate Legal Parent” to satisfy regulatory compliance, credit risk assessment, and tax consolidation. It asks: If this entity goes bankrupt, who pays the debts?

- The Sales Hierarchy (Opportunity View): Prioritizes the “Effective Sales Parent” to drive territory alignment, cross-selling, and incentive compensation. It asks: If I sell to the parent, can they force the child to buy?

When organizations conflate these two views, sales territories become unbalanced. Reps are assigned massive legal conglomerates that operate as fragmented, autonomous tribes, while distinct legal entities that function as a unified buying center are treated as strangers.

The Hidden Cost: The “Duplicate Data” Loop

The misalignment between these two hierarchies creates a massive data quality issue. When sales reps cannot find the correct Buying Group in the hierarchy (e.g., they look for “Google” but only find “Alphabet Inc”), they often create unintentional duplicates, fragmenting your revenue data. This “shadow CRM” makes it impossible to get a true 360-degree view of the customer.

The dichotomy through complex corporate archetypes

This article analyzes this dichotomy through complex corporate archetypes—Holding Shells, Foundations, Joint Ventures, and Franchises—and positions the solution landscape between Dun & Bradstreet (D&B) for financial truth and Delpha for commercial truth.

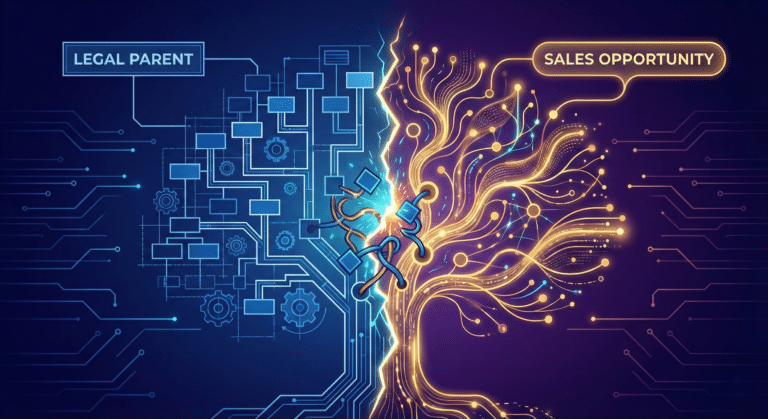

The Holding Shell: The LVMH Paradox

The “Holding Shell” is a classic example of a “False Parent” in sales. These entities sit at the top of a legal hierarchy to manage equity and family control but possess no operational function relevant to B2B sellers.

The Legal/Financial Truth (Agache)

If you look at the strict legal structure of the luxury giant LVMH, the hierarchy does not stop at LVMH Moët Hennessy Louis Vuitton SE. It rolls up through a series of holding companies designed to secure control for the Arnault family.

- Global Ultimate: Agache SCA (The Arnault Family Holding).

- Subsidiary: Financière Agache (Investment vehicle).

- Subsidiary: Christian Dior SE (Publicly listed holding company).

- Subsidiary: LVMH (The Operational Conglomerate).

The Finance View (D&B): A credit risk assessment must roll up to Agache SCA or Christian Dior SE because that is where the ultimate equity and control reside.

The Sales Truth (LVMH)

For a B2B sales representative selling enterprise software, logistics, or marketing services, assigning the account to “Agache SCA” is a strategic error.

- Agache is a Family Office: It has a tiny staff focused on wealth management and legal governance. It has no use for supply chain software or retail point-of-sale systems.

- LVMH is the Buying Center: The operational mandates (e.g., “Life 360” sustainability targets, Google Cloud AI partnerships) originate from LVMH.

The GTM Hierarchy Strategy:

- Discard: Agache SCA, Financière Agache, and Christian Dior SE. Tag them as Type: Holding Shell and exclude them from active sales territories.

- Designate: LVMH as the “Effective Global Parent.”

- Nuance: Even LVMH allows its “Maisons” (Sephora, Louis Vuitton, Bulgari) significant autonomy. For many products, the “Effective Parent” is actually the Maison itself.

The Fortress of Foundations: Rolex & IKEA

Foundations in Europe often act as corporate governance mechanisms to ensure perpetuity and minimize tax, rather than as operational charities. For sales teams, they function as “Data Dead Ends.”

The Rolex Case: Hans Wilsdorf Foundation

Rolex is a for-profit company wholly owned by a private charitable trust.

- Legal Parent: Hans Wilsdorf Foundation (Geneva).

- Operational Entity: Rolex S.A.

- The Sales Conflict: A CRM fed by strict legal data will assign the “Hans Wilsdorf Foundation” as the target account. This entity is a charity that gives grants to watchmaking schools and social causes. It does not buy steel, gold, or manufacturing robotics.

- Correction: The hierarchy must be “pruned” to stop at Rolex S.A. The Foundation is irrelevant to B2B commerce.

The IKEA Case: Stichting INGKA

IKEA is split into two separate corporate groups owned by two different foundations to separate “Retail” from “Brand/IP”.

- Ingka Group (Retail): Owned by Stichting INGKA Foundation.

- Inter IKEA Group (Brand/Supply): Owned by Inter IKEA Foundation.

The Sales Conflict: A rep selling logistics software to “IKEA” cannot treat these as one account. They are legally and operationally distinct. Selling to the Stichting (Foundation) is impossible. The sales hierarchy must recognize Ingka Holding B.V. and Inter IKEA Systems B.V. as two separate “Effective Parents,” effectively splitting the brand into two distinct customers.

Managing Joint Ventures: The Sony Honda Mobility Example

Joint Ventures (JVs), particularly 50/50 splits, are the “orphans” of account hierarchies. They fit neither parent’s mold and often operate as “Net New Logos.”

Case Study: Sony Honda Mobility (SHM)

SHM is a 50/50 JV between Sony and Honda established to build the “AFEELA” EV brand.

- Financial View: Equity method accounting. Neither Sony nor Honda fully consolidates SHM. D&B might link it to both or neither, creating a complex graph.

- Sales View: Who owns the territory?

- The Sony Rep: Claims it because it’s a “software-defined vehicle.”

- The Honda Rep: Claims it because it uses Honda factories.

The “Independent” Reality

SHM describes itself as a “Mobility Tech Company”. It has its own privacy policy, its own recruiting, and crucially, its own procurement autonomy.

- Direct-to-Consumer Model: Unlike Honda, which sells via dealers, SHM plans to sell online. This requires a completely different tech stack (Salesforce/Stripe vs. Dealer Management Systems).

- The Ruling: SHM must be treated as a Standalone Account in the GTM hierarchy.

- It is not a child of Honda (it breaks the dealer model).

- It is not a child of Sony (it manufactures cars).

- Action: Create a “Referral Link” to the parents for context, but do not roll up revenue or pipeline to the parent account owners. Treat it as a startup.

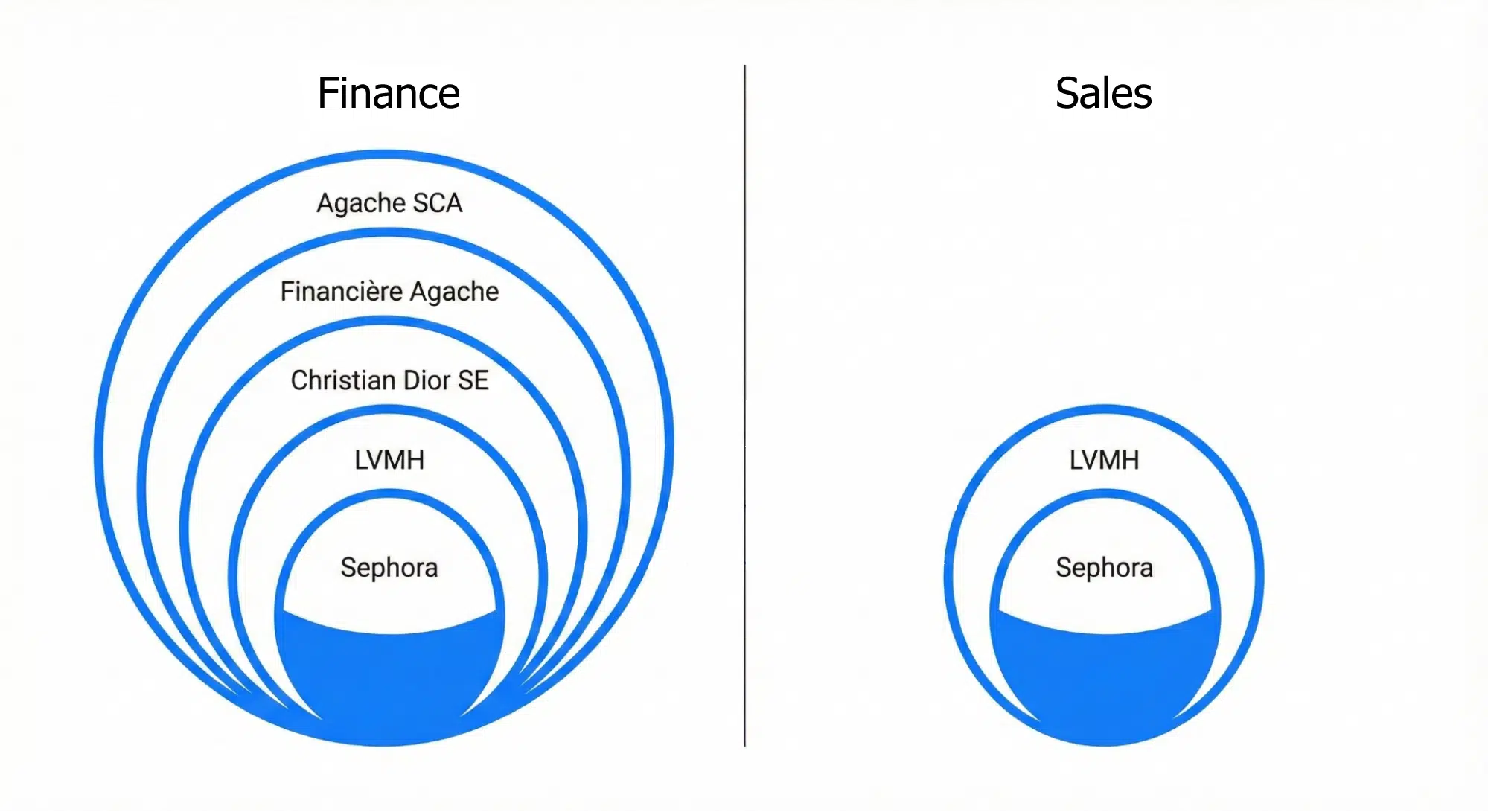

Handling Franchise Hierarchies: The Marriott Example

The hospitality industry offers the most complex “Who is the Customer?” problem in B2B data. In this sector, the name on the door (The Brand) is rarely the owner of the building (The Investor) or the employer of the staff (The Manager).

For a Finance team, the hierarchy follows the money (ownership). For a Sales team, the hierarchy must follow the decision-making power.

1. Real-World Complexity: JW Marriott Venice vs. KSL Capital

To visualize this, let’s look at the JW Marriott Venice Resort & Spa, a luxury 5-star property.

- The Brand (Flag): To the guest, this is a Marriott. It uses Marriott’s reservation system, loyalty program (Bonvoy), and branding standards.

- The Owner (Asset): In reality, the property was acquired by KSL Capital Partners, a Private Equity firm.

- The Manager: The day-to-day staff might be employed by a third-party management company or the brand itself, depending on the contract.

If you rely on standard financial data (like Dun & Bradstreet), the hierarchy will likely roll up to KSL Capital Partners as the Ultimate Legal Parent. While legally accurate, this creates a major friction point for sales teams.

2. The Conflict: Finance View vs. Sales View

Depending on what you sell, the “Effective Parent” changes. However, for most B2B commercial teams—especially in Tech and Services—the Legal Parent is a distraction.

| Product Being Sold | Effective Sales Parent | Why? |

|---|---|---|

| Furniture / Renovations | The Owner (KSL Capital) | The Owner holds the asset and pays for Capital Expenditures (CapEx). |

| Staffing / Cleaning | The Manager | The Management Company hires the staff and manages daily OpEx. |

| IT / Software / Marketing | The Brand (Marriott) | This is where Delpha focuses. The Brand mandates the tech stack (PMS, CRS) and operational standards. |

3. Why Delpha Focuses on the Brand

At Delpha, we prioritize the Brand Hierarchy over the Financial Owner (PE Firm) for three strategic reasons. We call this finding the “Commercial Truth.”

A. Targeting the Decision Maker, Not the Landlord

If you are selling Customer Experience software or Reservation tools, pitching to KSL Capital (the PE firm) is a waste of time. KSL is an investment firm focused on asset appreciation and EBITDA multiples; they do not decide which CRM the front desk uses.

- Delpha’s Logic: The operational budget and vendor selection criteria come from Marriott. Therefore, we route the account to the Marriott hierarchy to ensure you target the operational decision-makers, not the financial landlords.

B. Enabling Network Effects

Assigning the JW Marriott Venice to a sales rep who owns “KSL Capital” creates a disjointed territory. That rep would have a bag of mixed assets—ski resorts, city hotels, and unrelated real estate—with no common buying needs.

- Delpha’s Logic: By linking the hotel to Marriott, the account falls into the territory of the “Hospitality Major Accounts” rep. This rep can leverage a global Master Service Agreement (MSA) with Marriott HQ to close the deal at the Venice property more effectively.

The “Discarded Parent” Logic for Private Equity

In sales hierarchies, Private Equity firms act as “Holding Shells.” They are “Financial Sponsors” that rarely integrate the operations of their portfolio companies.

- Delpha’s Logic: Selling to Blackstone or KSL Capital HQ does not help you sell to the hotels they own. Delpha identifies these financial parents and “discards” them from the sales view, snapping the hierarchy to the Brand (Marriott) where the commercial interaction actually happens.

The 5 Commercial Logic Rules

The Delpha Commercial Protocol applies five specific logic rules to map the true “Decision-Making Unit” for revenue teams, prioritizing brand influence and operational autonomy over simple legal shareholding.

To accurately reflect how B2B buying decisions happen, we distinguish between a Legal Owner (who holds the shares) and a Commercial Parent (who sets the strategy). We apply the following five rules:

1. The Brand Supremacy Rule

Principle: If it carries the brand, it rolls up to the brand—regardless of legal separation.

Unlike legal hierarchies which separate franchises, we consolidate them. If an entity is a Franchisee, Authorized Operator, or shares a Conglomerate Name (e.g., a Tata Group entity), we designate the Global Brand as the Ultimate Parent.

- Commercial Logic: Sales teams sell to the “Brand Ecosystem,” and buying standards/technology stacks are often dictated by the Global Brand, even for legally distinct operators.

2. The “Financial Firewall” Rule

Principle: Investors are not parents.

We explicitly discard Private Equity firms, Venture Capitalists, and Asset Managers from the hierarchy. When an ownership chain hits a Financial Sponsor, we stop before the sponsor and designate the Portfolio Company as its own Ultimate Parent.

- Commercial Logic: A Private Equity firm does not dictate the daily software procurement or commercial strategy of its portfolio companies. The portfolio company acts independently and should not be buried under an investment firm’s account.

3. The State Separation Rule

Principle: Governments are not commercial headquarters.

If an entity is majority-owned by a Government, State, or Municipality, we treat the entity as Independent (Self-Ultimate) and discard the State owner.

- Commercial Logic: “The Republic of France” is not a Target Account. State-Owned Enterprises (SOEs) usually operate with commercial autonomy and should not be grouped into a single “Government” account.

4. The Shared Sovereignty Rule

Principle: Joint Ventures have no single master.

When an entity is a Joint Venture (50/50 split) or a Consortium, it is classified as Independent. We do not arbitrarily assign it to one parent, nor do we create a false “partial” record.

- Commercial Logic: JVs are unique buying centers with their own budgets and distinct IT environments, separate from their parent companies.

5. The “Shell” Bypass Rule

Principle: Ignore the legal wrapper; find the operating engine.

If the legal Ultimate Parent is a Foundation, Trust, or Holding Shell, we traverse through it to find the effective Operating Group.

- Commercial Logic: Sales teams need to identify the corporate leadership team (the C-Suite), not the legal vehicle used effectively for tax planning or inheritance purposes.

Summary: Legal vs. Commercial View

| Scenario | Legal/Finance View (Standard) | Commercial/Sales View (Delpha) |

|---|---|---|

| Franchise | Independent Company | Child of Global Brand |

| Private Equity | Ultimate Parent | Ignored (Portfolio Company is Parent) |

| Joint Venture | 50% / 50% Split | Independent Entity |

| State-Owned | Government Owned | Independent Entity |

| Holding Shell | Ultimate Parent | Traverse to Operating Group |

From Logic to Reality: The “Waterfall of Truth”

Defining the 5 Commercial Logic Rules is only half the battle. The second challenge is finding the data to execute them. In the real world, corporate data is messy and often contradictory—a regulatory filing might show one parent, while the company’s website claims another, and a LinkedIn profile suggests a third.

You cannot build a reliable Commercial Hierarchy if you treat all data sources as equal. To resolve these inevitable conflicts without human intervention, Delpha applies a strict Source Hierarchy. This acts as a “Waterfall of Truth,” ensuring that high-conviction, primary evidence always overrides outdated or secondary databases:

The Delpha Source Hierarchy is:

- Company Website (Direct Digital Footprint):

- Logic: The primary signal of commercial identity. Delpha’s agents analyze the entity’s self-declared affiliation and branding to determine if it presents itself as an independent operator or a subordinate unit.

- Global Brand Websites (Commercial Network Verification):

- Logic: Validating the operational link by checking if the subsidiary is officially listed within the parent’s commercial ecosystem (e.g., location finders, brand portfolios), which confirms shared infrastructure.

- Press Releases (Strategic Announcements):

- Logic: M&A activity dictates operational change.

- Rule A: News < 3 years old is Primary Evidence (recent acquisitions often imply active integration efforts).

- Rule B: News > 3 years old is Secondary Evidence (valid only if not contradicted by Source 1 or 2, ensuring divested units are not incorrectly linked).

- Securities Filings (Regulatory Disclosures):

- Logic: Used to resolve ambiguity in complex structures (e.g., 10-K filings), distinguishing between operational subsidiaries and purely financial “Variable Interest Entities.”

- Official Business Registries (Legal Baseline):

- Logic: The “Fail-Safe.” Used only when commercial sources (1-4) are silent. This ensures that legal shells (like Agache) are only used as a parent of last resort when no commercial parent can be identified.

Architecture of Truth: Delpha vs. Dun & Bradstreet

To solve this, organizations must maintain two parallel truths: a Financial Truth for the back office and a Commercial Truth for the front office.

Dun & Bradstreet (D&B): The Financial Guardian

D&B provides the Legal Hierarchy. It is the gold standard for:

- Risk: “If this child defaults, can we sue the parent?”

- Compliance: “Is the Ultimate Beneficial Owner (UBO) sanctioned?”

- Scope: It includes every shell company, dormant entity, and holding firm (like Agache SCA).

- Role: The “Skeleton” of your data. Use D&B to populate the legal fields (Global_Ultimate_DUNS) but do not use this structure for sales territories.

Delpha: The Architect of Sales Parenting

Delpha provides the GTM Hierarchy. It functions as the intelligence layer that curates the data for revenue execution.

Role: The “Muscle” of your data. Delpha focuses on Buying Power, not just equity. It identifies the “Effective Parent” by analyzing how companies actually present themselves and behave in the market.

Unlike generic AI that guesses relationships, Delpha determines the “Commercial Truth” using a strict, evidence-based priority list that mimics how a human researcher would validate a buying relationship.

Decision Guide: When to Use Legal vs. Commercial Hierarchies

The choice between the Financial Hierarchy (D&B) and the Sales Hierarchy (Delpha) is not binary; it is based on the specific business use case.

| Use Case | Recommended Solution | Rationale |

|---|---|---|

| Credit Risk Assessment | D&B (Financial) | Risk aggregates legally. If a subsidiary defaults, Finance needs to know the Ultimate Legal Parent (e.g., Agache SCA) to assess total liability exposure. |

| KYC / AML Compliance | D&B (Financial) | Compliance requires identifying the Ultimate Beneficial Owner (UBO) to screen for sanctions, money laundering, and politically exposed persons. |

| Territory Management | Delpha (Sales) | Territories must be “fair” and “actionable.” Delpha removes non-buying parents (PE firms, Holding Shells) to prevent territory bloat and assign reps to actual decision-makers. |

| Account-Based Marketing (ABM) | Delpha (Sales) | Marketing spend must target the Buying Group. Targeting a Foundation or Holding Shell is a waste of budget. Delpha ensures ads reach the operational entity (e.g., Rolex SA, not the Foundation). |

| Agentic AI Systems | Delpha (Sales) | Autonomous AI agents need “Operational Context” to function. If an agent is tasked with “Finding a buyer at Sony Honda Mobility,” using a legal tree might wrongly route the agent to a Honda dealer contact. Delpha ensures the agent engages the correct, autonomous buying center. |

| Real 360° Account View | Delpha (Sales) | A true 360° view must aggregate data based on Commercial Relevance, not just equity. Delpha consolidates opportunities and support tickets from operationally linked units, preventing the noise of irrelevant legal subsidiaries from cluttering the dashboard. |

| Global Spend Analysis | Hybrid | Use D&B to see total spend by legal owner (for leverage), but use Delpha to categorize spend by decision-making unit (for strategy). |

Conclusion

The Dynamic Data Model

The ultimate goal of automated Account Parenting is a dynamic data model. Instead of a single, compromised hierarchy that frustrates everyone, RevOps teams gain the ability to toggle between different “truths” depending on the business objective.

When the CFO runs a credit risk report, the data aligns perfectly to the Ultimate Legal Parent based on rigid ownership data. Conversely, when the CRO carves out new territories, the data snaps into alignment based on the GTM Agent’s commercial protocols, ensuring equitable books of business focused on actual buying centers.

The New Stakeholder: Account Hierarchies in the Age of AI

While humans can sometimes tolerate a “messy” hierarchy by asking a colleague for clarification, AI Agents cannot. As organizations deploy autonomous agents (like Salesforce Agentforce) to route leads or summarize pipeline, the cost of a rigid “Finance-only” hierarchy skyrockets.

An AI agent instructed to “Email the decision-makers for all Luxury Goods brands” will fail if your hierarchy only sees “LVMH Moët Hennessy Louis Vuitton SE” as a single holding company. The AI needs a Knowledge Graph—a flexible web of relationships that understands “Louis Vuitton” is a brand distinct from “Tiffany & Co”.

Without this Entity Resolution, your AI agents will fail in two specific ways:

- Hallucinate: Inventing relationships that don’t exist to fill data gaps.

- Under-perform: Missing 80% of the buying centers because they are hidden under a “Holding Shell.”

Future-Proofing: The “Translator” Layer

To prepare for this AI-driven future, modern data teams must move beyond static parent-child fields toward automated Entity Resolution. As noted in the Databricks guide to Customer 360, the goal is to translate disparate attributes into a unified ID using machine learning.

You need a data quality layer that acts as a translator—serving the strict “Legal Entity” to your ERP for billing, while dynamically serving the flexible “Buying Group” to your AI Agents via API.

By using specialized AI such as Delpha Ultimate Parent to manage this complexity in the background, the enterprise no longer has to choose between compliance and revenue performance. It gets both.

Finance has the Legal view. Give Sales the Commercial reality. Stop assigning territories to legal shells and start targeting the true Buying Parent with Delpha.

Want to learn more about Delpha?